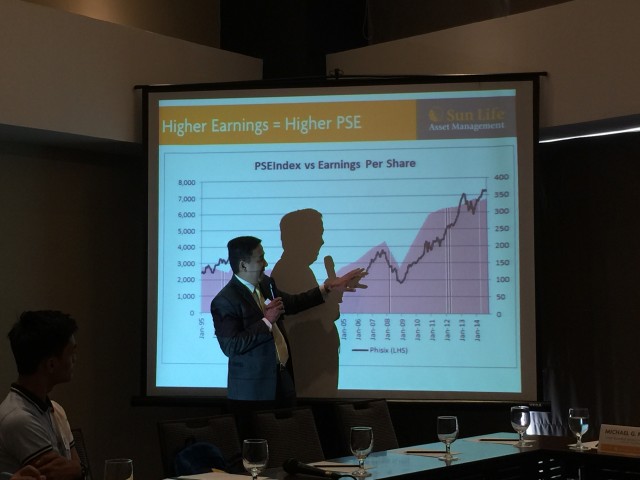

Sun Life Asset Management Corporation, Inc. (SLAMCI) launched SLAMCI Asset Management Press Conference held at Seda Hotel last Aug 7, 2015 aiming to increase awareness for Filipinos nationwide about good financial investments specifically in mutual funds.

The Presscon was joined by various business personage, media groups and aspiring spectators who sets to enter the world of investments. SLAMCI provides an arena for people to get to know more about good financial investments specifically in mutual funds, which will eventually lead to a more stable future not just for the individual who’ll invest but also for the country’s economic growth.

As reported, Davao, Cebu and Ilo-Ilo city were the primary locations where steadily fast economic growth is evident, compared to other major cities of the country.

According to Michael Oliver G. Manuel, Chief Business Development Officer, speaker on the, financial investments, right at this present economic situation in the Philippines is a very great deal. This is when the monetary asset circulates to the economy, as the purchasing power increases, thus interest rates in borrowing funds decreases because funds are readily available, therefore borrowers of funds for another type of investment increases. That will result to growth on the money you invested as it will be used up and will eventually multiply. This is basically pictured out in the Theory of demand and supply.

In addition, Sun Life, as a 120-year company sustains its economic growth through PPP (Private Public Partnership) and is noted to have the biggest participation in the country compared to other financial company. With this you will be more secure investing in Sun Life, unlike funding with banks which only has a sustainability of more than 12 years and would require more capital, Sun Life’s Project Financing will last until 25 years and flexible capital is only needed.

Unknown to the majority, it was 120 years ago, Sun Life Financial has introduced Life Insurance in the Philippines in 1895, 3 years before the country secured independence from the 300-year Spanish rule, suspended its business operations during World War II following the invasion of the Japanese forces. However it continued to run underground operation (see company profile at www.sunlife.com). This delineates the stability and continuity of the company’s financial product and services to the Filipinos up until this time and to the coming days.

Sun Life Financial steadily proves that every cent investment from the citizens of this country will go somewhere but augment for the purpose of financial growth of its investors and the economy. A far much better investment than those easy-to-get-rich financial plots known to be only days to months old established by unreliable entity, that offers promising investment growth without foresight.